Zakat on Stocks and Investment: Zakat is one of the five pillars of Islam, an obligatory form of charity that purifies wealth and supports those in need. If you own stocks, it is crucial to calculate Zakat correctly to fulfill your religious duty. This guide explains how to calculate Zakat on stocks or shares in 2025 in a simple and practical way.

When calculating Zakat on stocks, several common questions arise. Firstly, should Zakat be paid on stocks that have lost value? Yes, Zakat is due on the market value of stocks on your Zakat due date, regardless of whether their price has decreased. However, if your overall stock portfolio is in loss and your total wealth falls below the Nisab, you are not required to pay Zakat.

Another common question is whether Zakat should be paid on dividends? If dividends are reinvested, they are included in the stock value, but if they are kept as cash, they should be added to your cash balance, and Zakat should be paid on them accordingly.

Who Needs to Pay Zakat on Stocks?

Zakat on stocks applies to Muslim investors who own shares in companies or businesses and meet the Nisab threshold. The Nisab is equivalent to 87.47 grams of gold or 612.35 grams of silver in value.

If your total wealth, including stocks, exceeds the Nisab amount for a full lunar year, you must pay 2.5% Zakat on your stock holdings.

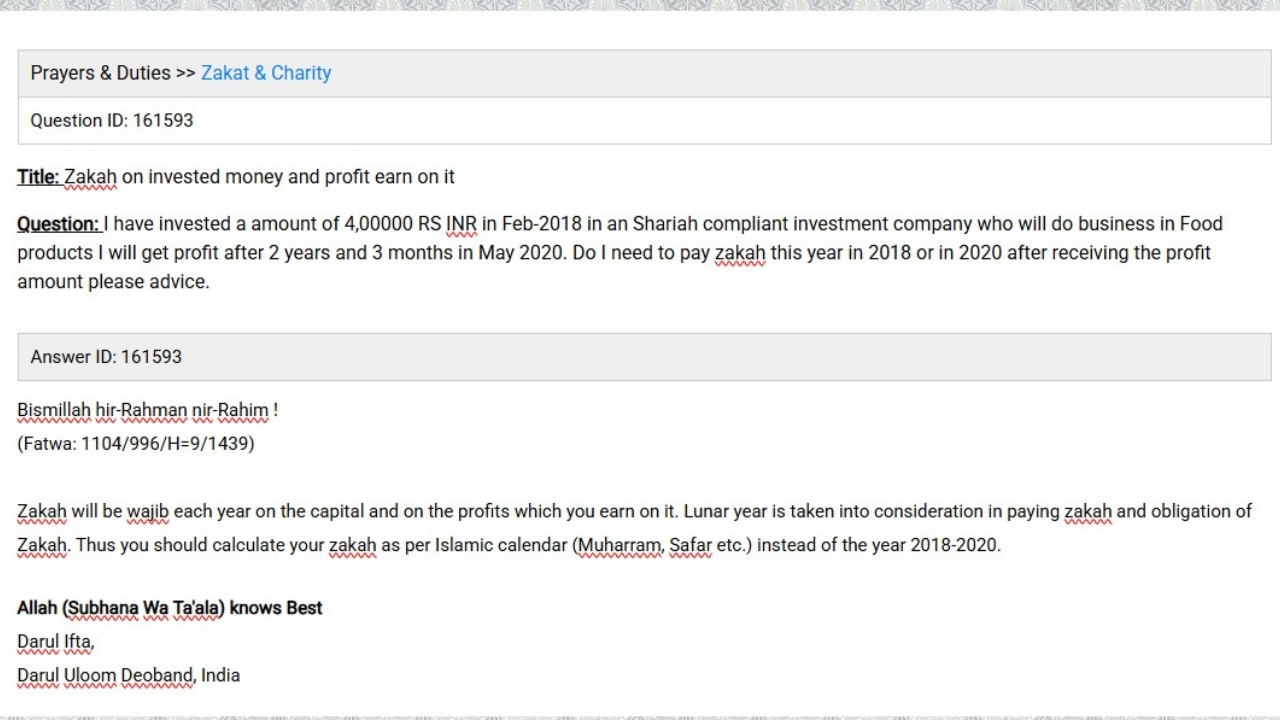

Darul Uloom Deoband Fatwa on Zakat on Investments

A ruling from Darul Uloom Deoband, India states that Zakat is obligatory each year on both the capital and the profits earned from investments. The Islamic (lunar) calendar should be used for Zakat calculations. According to this fatwa from Darul Uloom Deoband (see screenshot below), Zakat on stocks is obligatory if the Nisab threshold is met.

Three Methods to Calculate Zakat on Stocks or Share

There are three main approaches to calculating Zakat on stocks:

1. Market Value Approach

- Best for: Short-term traders

- Calculation: Pay 2.5% of the current market value of all your stocks.

- Example: If your shares are worth ₹10,000, your Zakat is ₹10,000 × 2.5% = ₹250.

2. Zakatable Assets Approach

- Best for: Long-term investors

- Calculation: Identify the percentage of the company’s liquid assets (cash, accounts receivable, and inventory) and pay 2.5% on that portion.

- Example: If a company’s liquid assets are 20% of total assets and your stocks are worth ₹10,000, then the Zakatable amount is ₹2,000. Zakat = ₹2,000 × 2.5% = ₹50.

3. The 25% Fixed Approach

- Best for: Investors seeking a simplified method

- Calculation: Assume 25% of the company’s assets are Zakatable and pay 2.5% on that amount.

- Example: If your stocks are worth ₹10,000, the Zakatable portion is ₹2,500. Zakat = ₹2,500 × 2.5% = ₹62.50.

Checkout Our : Online Zakat Calculator Tool

Follow this Easy Steps to Calculate Zakat on Stocks

- Determine Your Zakat Date: Choose a fixed Islamic date each year (e.g., 1st Ramadan).

- Identify Your Stocks: List all shares and their current market value.

- Check Your Investment Type: Decide if they are for Short-term trading or long-term holding.

- Calculate the Zakatable Amount:

- Short-Term Trading stocks: 2.5% of the total market value.

- Long-term stocks: 2.5% of net Zakatable assets.

- Deduct Any Liabilities: If you have outstanding debts related to stock investments, you may deduct them.

- Pay Your Zakat: Distribute it to eligible recipients (poor, needy).

Conclusion

Calculating Zakat on stocks is a vital financial and spiritual responsibility for Muslim investors. Whether you trade stocks actively or hold them for the long term, understanding the correct Zakat calculation method ensures you fulfill your duty properly. By paying Zakat, you purify your wealth and contribute to the welfare of the Ummah.

May Allah accept your Zakat and bless your earnings. If you found this guide helpful, share it with your friends and family so they can also learn how to calculate Zakat on stocks or Investment.

Hasan is the founder of HalalFinance.co.in, created after personally struggling to find reliable answers about halal investing in stocks. With a finance background and a passion for helping the Muslim community, He now shares well-researched, transparent, and authentic content to empower Muslims on their path to halal wealth-building.