Aegis Vopak Terminals Ltd is a joint venture between Aegis Logistics Ltd and Netherlands-based Royal Vopak, specializing in the storage and handling of liquefied petroleum gas (LPG) and liquid bulk products. As of June 30, 2024, the company operates a network of storage tank terminals across major Indian ports, boasting an aggregate storage capacity of approximately 1.50 million cubic meters for liquid products and 70,800 metric tons for LPG. This infrastructure supports India’s growing energy and chemical sectors by providing critical storage solutions.

The Aegis Vopak Terminals Ltd IPO is a book-built issue aiming to raise ₹2,800 crore through a fresh issue of 11,91,48,936 equity shares. The IPO will open for subscription on May 26, 2025, and close on May 28, 2025. The price band is set at ₹223 to ₹235 per share. The minimum lot size for retail investors is 63 shares, requiring an investment of ₹14,805. The IPO is proposed to be listed on both the BSE and NSE, with a tentative listing date of June 2, 2025.

Is Aegis Vopak Terminals Ltd IPO Halal or Not?

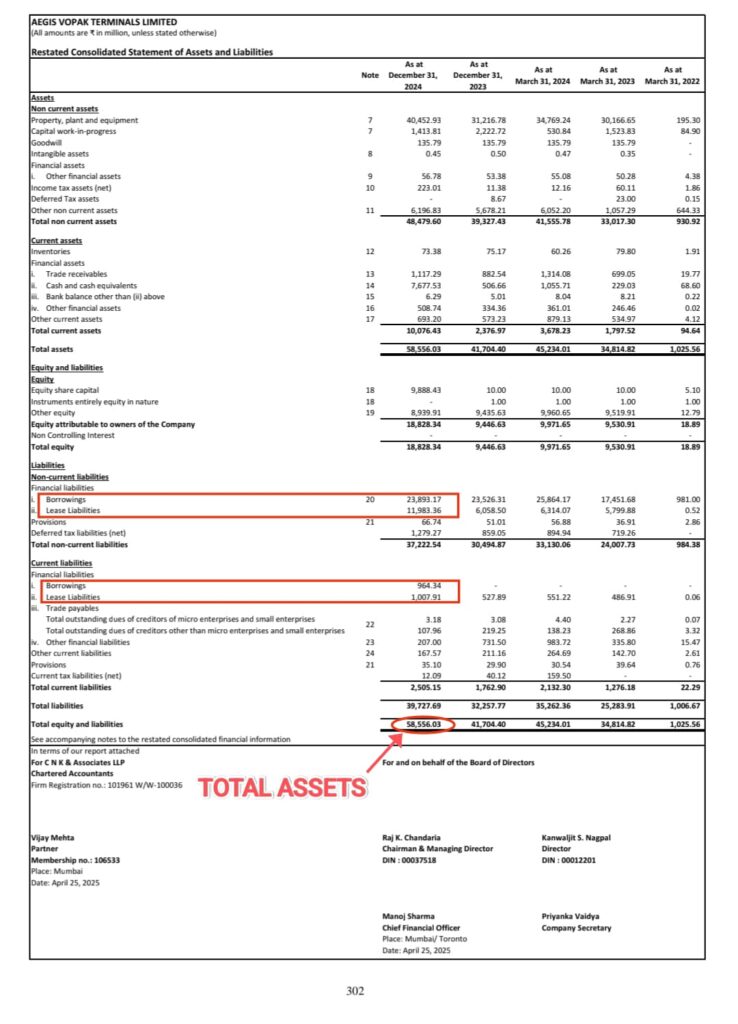

The Aegis Vopak Terminals Ltd IPO is considered Not Halal and Non-Shariah Compliant because the company fails the “Interest-Bearing Debt to Total Assets” criterion, with an interest-bearing debt ratio of 64.64%, surpassing the allowable 33% limit under Shariah guidelines.

For transparency, we’ve attached the official Assets and Liabilities Statement of Aegis Vopak Terminals Ltd below as proof of our Shariah Stock and IPOs screening results.

Shariah Compliance Screening of Aegis Vopak Terminals Ltd

| Criteria | Value | Status |

| Business Activity | Automobile & Ancillaries | ✅ PASS |

| Impermissible Income to Total Revenue | 2.31% | ✅ PASS |

| Interest-Bearing Debt to Total Assets | 64.64% | ❌ FAIL |

| Illiquid Assets to Total Assets Ratio | 71.86% | ✅ PASS |

| Net Liquid Assets vs Market Capitalization | Compliant as per Shariah principles | ✅ PASS |

| Non-Compliant Investments to Total Assets | Less than 33% (Compliant) | ✅ PASS |

Also Read: Is Schloss Bangalore Ltd IPO Halal or Not? Date, Price, Listing Details

Business Overview – Aegis Vopak Terminals Ltd

Aegis Vopak Terminals Ltd (AVTL), established in 2013, is a joint venture between Aegis Logistics Limited and Royal Vopak of the Netherlands. The company specializes in the storage and handling of liquefied petroleum gas (LPG) and various liquid products.

AVTL operates a network of terminals across major Indian ports, providing essential infrastructure for the energy and chemical sectors. With a focus on safety and efficiency, AVTL plays a crucial role in India’s supply chain for vital commodities.

Aegis Vopak Terminals Ltd IPO Timeline

| Event | Date |

|---|---|

| IPO Opening Date | May 26, 2025 |

| IPO Closing Date | May 28, 2025 |

| Expected Allotment Date | May 29, 2025 |

| Initiation of Refunds | May 30, 2025 |

| Credit of Shares to Demat A/c | May 30, 2025 |

| Expected Listing Date | June 2, 2025 |

| UPI Mandate Confirmation Deadline | 5 PM on May 28, 2025 |

Aegis Vopak Terminals Ltd IPO Price Details

| IPO Date | May 26, 2025 to May 28, 2025 |

| Expected Listing Date | June 2, 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹223 to ₹235 per share |

| Lot Size | 63 Shares |

| Total Issue Size | 11,91,48,936 shares (aggregating up to ₹2,800.00 Cr) |

| Fresh Issue | 11,91,48,936 shares (aggregating up to ₹2,800.00 Cr) |

| Issue Type | Book-built issue |

| Listing At | BSE, NSE |

| Pre-Issue Shareholding | 98,88,42,553 shares |

| Post-Issue Shareholding | 1,10,79,91,489 shares |

Aegis Vopak Terminals Ltd Financial Information (Restated Consolidated)

| Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 5,855.60 | 4,523.40 | 3,481.48 | 102.56 |

| Revenue | 476.15 | 570.12 | 355.99 | 0.00 |

| Profit After Tax | 85.89 | 86.54 | -0.08 | -1.09 |

| Net Worth | 2,037.61 | 1,151.94 | 1,098.20 | -0.53 |

| Reserves and Surplus | 0.00 | 0.00 | 0.00 | 0.00 |

| Total Borrowing | 2,485.75 | 2,586.42 | 1,745.17 | 98.10 |

| Amount in ₹ Crore | ||||

Refer to Aegis Vopak Terminals IPO RHP for detailed financial information.

Conclusion

Aegis Vopak Terminals Ltd IPO Considered Not Halal and Non-Shariah compliant due to its high reliance on interest-based debt. However, investors should conduct their own due diligence and review the company’s financials periodically for any changes in compliance.

Disclaimer: The information on Halalfinance.co.in is for educational and informational purposes only and not financial advice. We are not liable for any investment decisions you make; always consult a financial advisor before investing.

Hasan is the founder of HalalFinance.co.in, created after personally struggling to find reliable answers about halal investing in stocks. With a finance background and a passion for helping the Muslim community, He now shares well-researched, transparent, and authentic content to empower Muslims on their path to halal wealth-building.