Belrise Industries Ltd is a Maharashtra based automotive components manufacturer engaged in the production and supply of a diverse range of products, including chassis systems, body structures, exhaust systems, and suspension components. Established in 2006, the company serves major automotive OEMs and also provides contract manufacturing services, catering to both domestic and international clients in the automotive industry.

Belrise Industries Ltd is coming out with a book-built IPO worth ₹2,150.00 crores, entirely comprising a fresh issue of 23.89 crore equity shares. The IPO will open for public bidding on May 21, 2025, and close on May 23, 2025. The company has fixed the price band for the issue between ₹85 to ₹90 per share.

For retail investors, the minimum application size is 166 shares, translating to an investment of ₹14,940 at the higher price band. Small Non-Institutional Investors (sNII) can apply for a minimum of 14 lots (2,324 shares) requiring ₹2,09,160, while Big Non-Institutional Investors (bNII) need to bid for at least 67 lots (11,122 shares) worth ₹10,00,980. Post allotment, the company’s shares are proposed to be listed on both BSE and NSE, with a tentative listing date set for May 28, 2025.

Is Belrise Industries Ltd IPO Halal or Not? Verified Shariah Status with Financial Report Proof

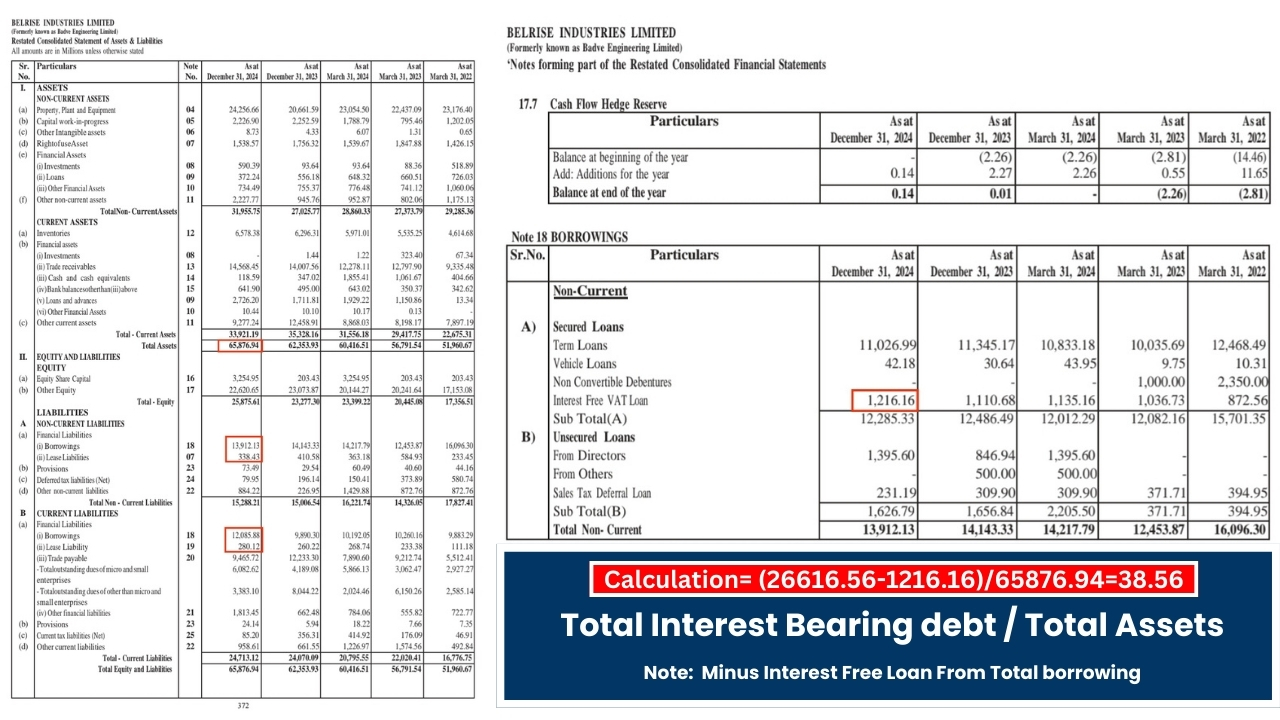

The Belrise Industries Ltd IPO is considered Not Halal and Non-Shariah Compliant because the company fails the “Interest-Bearing Debt to Total Assets” criterion, with an interest-bearing debt ratio of 38.56%, surpassing the allowable 33% limit under Shariah guidelines. (Allah Knows the Best)

Refer to Belrise Industries IPO RHP for detailed information.

Also Read : What to do When a Halal Stock Turns Non-Halal? Halal Investors Guide (2025)

Shariah Compliance Screening of Belrise Industries Ltd IPO

For an IPO or Stocks to be considered Halal, it must pass all the Shariah screening criteria, which include:

| Criteria | Value | Status |

| Business Activity | Automobile & Ancillaries | ✅ PASS |

| Impermissible Income to Total Revenue | 0.85% | ✅ PASS |

| Interest-Bearing Debt to Total Assets | 38.56% | ❌ FAIL |

| Illiquid Assets to Total Assets Ratio | 52.54% | ✅ PASS |

| Net Liquid Assets vs Market Capitalization | Compliant as per Shariah principles | ✅ PASS |

| Non-Compliant Investments to Total Assets | Less than 33% (Compliant) | ✅ PASS |

Belrise Industries Ltd IPO Timeline

| IPO Opening Date | Wed, May 21, 2025 |

| IPO Closing Date | Fri, May 23, 2025 |

| Expected Allotment Date | Mon, May 26, 2025 |

| Refund Initiation | Tue, May 27, 2025 |

| Shares Credited to Demat | Tue, May 27, 2025 |

| Expected Listing Date | Wed, May 28, 2025 |

| UPI Mandate Confirmation Deadline | 5 PM on, May 23, 2025 |

Belrise Industries Ltd IPO Price Details

| IPO Date | May 21, 2025 to May 23, 2025 |

| Expected Listing Date | Wed, May 28, 2025 |

| Face Value | ₹5 per share |

| Issue Price Band | ₹85 to ₹90 per share |

| Lot Size | 166 Shares |

| Total Issue Size | 23,88,88,888 shares (aggregating up to ₹2,150.00 Cr) |

| Fresh Issue | 23,88,88,888 shares (aggregating up to ₹2,150.00 Cr) |

| Issue Type | Book-built issue |

| Listing At | BSE, NSE |

| Pre-Issue Shareholding | 65,09,90,304 shares |

| Post-Issue Shareholding | 88,98,79,192 shares |

Business Overview – Belrise Industries Ltd

Belrise Industries Ltd, established in 2006 and headquartered in Pune, Maharashtra, is a leading automotive components manufacturer specializing in the design, development, and production of a wide range of critical vehicle systems. The company’s product portfolio includes chassis systems, body structures, exhaust systems, and suspension components, catering to both passenger and commercial vehicle segments.

In addition to manufacturing, Belrise Industries offers integrated engineering and design solutions, partnering closely with major automotive OEMs in India and global markets. With a strong focus on innovation and operational excellence, the company operates multiple state-of-the-art manufacturing facilities and employs a dedicated workforce of over 3,000 professionals. Belrise Industries has established a significant presence in the Indian automotive sector and continues to expand its footprint internationally.

Belrise Industries Ltd Financial Information (Restated)

| Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 6,587.69 | 6,041.65 | 5,679.15 | 5,196.07 |

| Revenue | 6,064.76 | 7,555.67 | 6,620.78 | 5,410.68 |

| Profit After Tax | 245.47 | 352.70 | 356.70 | 307.24 |

| Net Worth | 2,577.55 | 2,331.92 | 2,038.20 | 1,734.45 |

| Reserves and Surplus | 2,252.24 | 2,014.43 | 2,024.16 | 1,715.31 |

| Total Borrowing | 2,599.80 | 2,440.98 | 2,271.40 | 2,597.96 |

| Amount in ₹ Crore | ||||

Conclusion

The Belrise Industries Ltd IPO Considered Not Halal and Non-Shariah compliant due to its high reliance on interest-based debt. However, investors should conduct their own due diligence and review the company’s financials periodically for any changes in compliance.

Disclaimer: The information on Halalfinance.co.in is for educational and informational purposes only and not financial advice. We are not liable for any investment decisions you make; always consult a financial advisor before investing.

Hasan is the founder of HalalFinance.co.in, created after personally struggling to find reliable answers about halal investing in stocks. With a finance background and a passion for helping the Muslim community, He now shares well-researched, transparent, and authentic content to empower Muslims on their path to halal wealth-building.

1 thought on “Is Belrise Industries Ltd IPO Halal or Not? Verified Financial Proofs You Must See!”